IRS Under Fire: Whistleblower Challenges Gates Foundation's Tax-Exempt Status Amid Conflict of Interest Claims

Whistleblower vs. IRS: Gates Foundation's charity or profit? Lawyer's past ties raise eyebrows. Tax status delays loom. Full story inside!

IRS Defends Against Whistleblower Lawsuit Over Gates Foundation Tax-Exempt Status, Critics Point to Legal Flaws, Delays, and Potential Conflicts

Miami, FL - A legal battle in the Southern District of Florida has spotlighted not just the intricacies of tax law but also the ethical dimensions of legal representation. William S. Scott filed an Amended Appeal and Petition for Writ of Mandamus against the Internal Revenue Service (IRS) regarding the tax-exempt status of the Bill and Melinda Gates Foundation, under case number 1:24-cv-24123-CMA and submitted on 1.8.2025. Scott alleges that the foundation engaged in for-profit activities through vaccine sales, challenging the IRS's denial of his whistleblower claim.'

Read Part 1 of this story here:

Scott's Petition:

Scott, acting pro se, seeks judicial intervention to compel the IRS to investigate these claims, arguing that the denial of his whistleblower award under IRC § 7623 was unjust. He requests a Writ of Mandamus under 28 U.S.C. § 1340 and § 1361 to enforce an investigation into the foundation's activities.

IRS's Legal Standpoint:

The IRS, demonstrating the greatest act of government speed and efficiency in modern history, responded to the latest challenge to the Gates Foundation’s tax-exempt status in a mere 5 days. Represented by U.S. Department of Justice attorneys David A. Hubbert and Matthew L. Paeffgen, defends the discretionary nature of its decision, suggesting that Scott's recourse should be through the U.S. Tax Court, as per Li v. Commissioner. They argue that not all IRS actions are subject to review under the Administrative Procedures Act (APA).

Potential Flaws and Conflicts of Interest:

Selective Use of Precedent: The IRS's reliance on Li v. Commissioner could be seen as too narrow for this particular case, where unique allegations of for-profit activities by a charity are at stake.

Discretion vs. Accountability: Scott's petition questions whether the IRS adequately investigated his claims, suggesting a possible lack of accountability.

Adequate Remedy Questioned: Scott argues that the Tax Court does not provide the relief he seeks, particularly a compelled investigation.

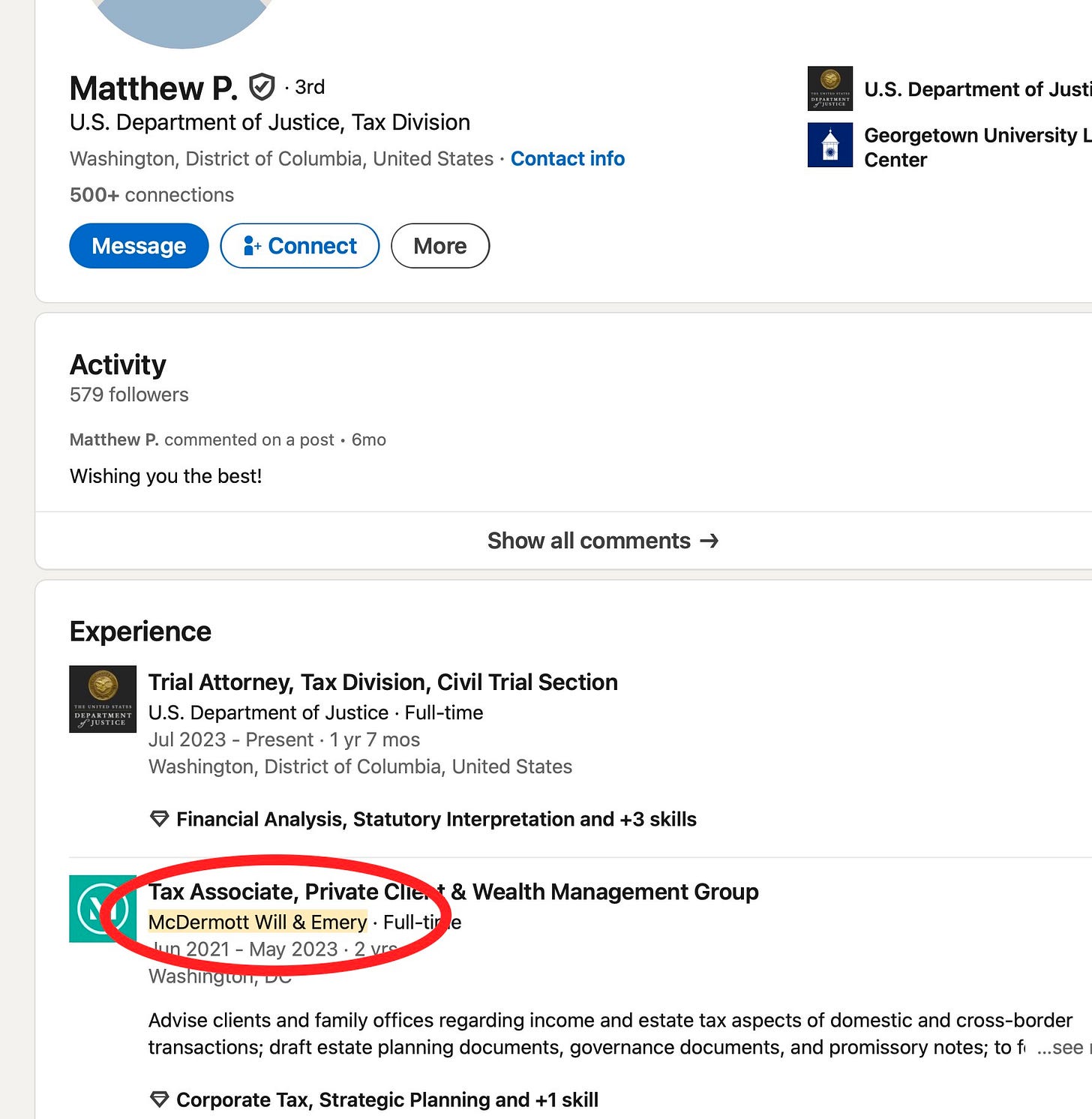

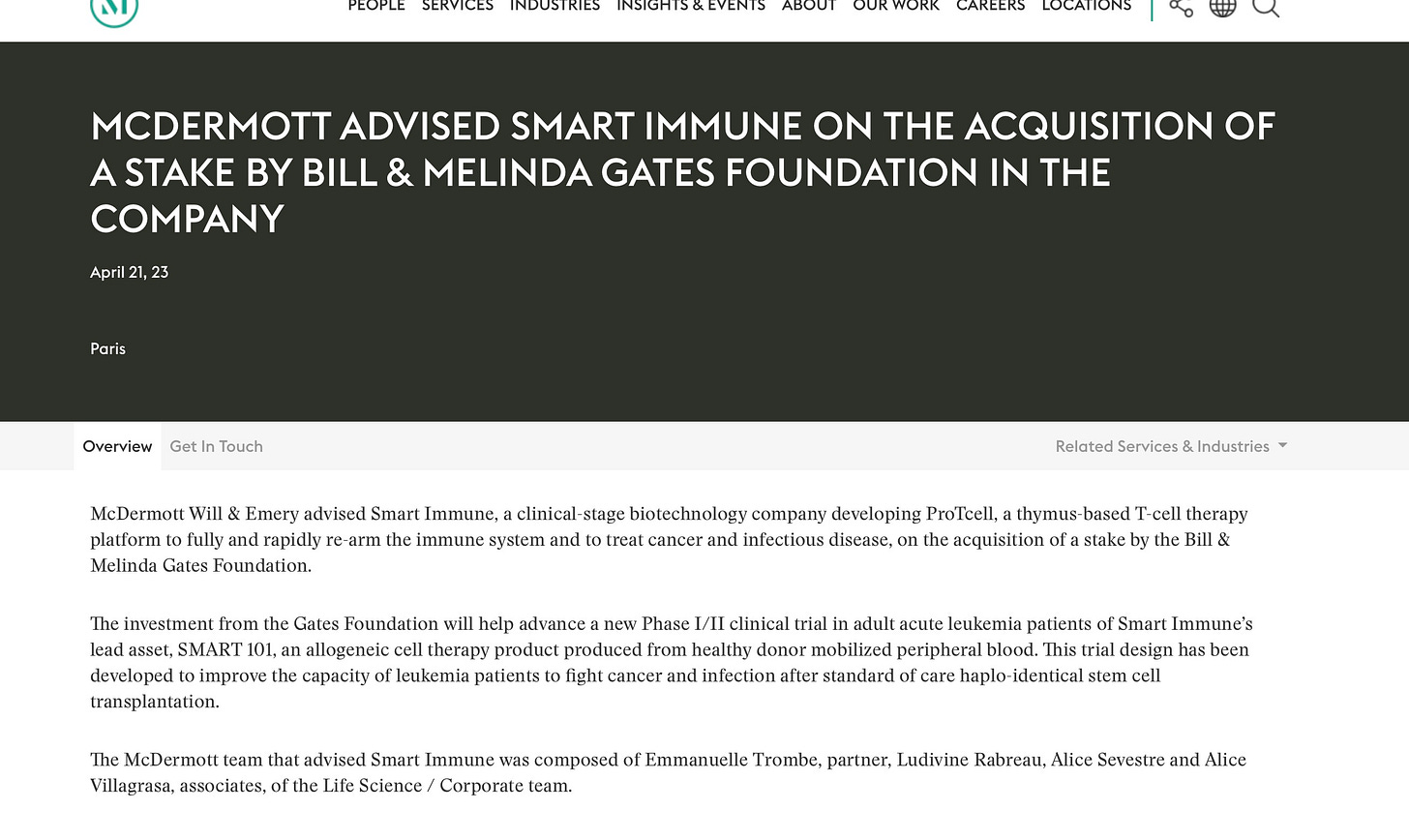

Potential Conflict of Interest: The case has drawn attention due to Matthew L. Paeffgen's prior employment with McDermott Will & Emery, a Private Client & Wealth Management Group, which advised Smart Immune, a Gates Foundation 5 million dollar equity investment partner. This connection raises questions about conflict of interest, especially given federal laws and judicial ethics requiring attorneys to recuse themselves when conflicts exist. Under 28 U.S.C. § 455 and Rule 1.7 of the American Bar Association's Model Rules of Professional Conduct, attorneys must withdraw from representation if their impartiality might reasonably be questioned due to a conflict. This has been upheld in various federal cases where judges or attorneys were required to step back from cases due to personal or professional connections that could bias their judgment or create the appearance of impropriety.

Lack of Depth in Argumentation: Critics might argue that the IRS's response does not fully address the substantive allegations regarding the Gates Foundation's activities.

Mandamus and Lack of Discretion: Scott insists the IRS has a duty to investigate, not merely a discretionary power, particularly in cases involving potential tax fraud.

Historical Context - IRS and Non-Profit Tax Status Challenges:

Tea Party Scandal (circa 2013): Exposed issues with IRS discretion, leading to legal challenges over delays in granting tax-exempt status to certain groups.

Z Street v. Koskinen: Highlighted delays attributed to political considerations, ending with a settlement.

The Becket Fund for Religious Liberty: Showcased inconsistencies in IRS application of tax-exempt status criteria.

Freedom Path v. IRS: Acknowledged improper handling of applications, reflecting broader issues of fairness.

Unusual Delays in Granting Non-Profit Status:

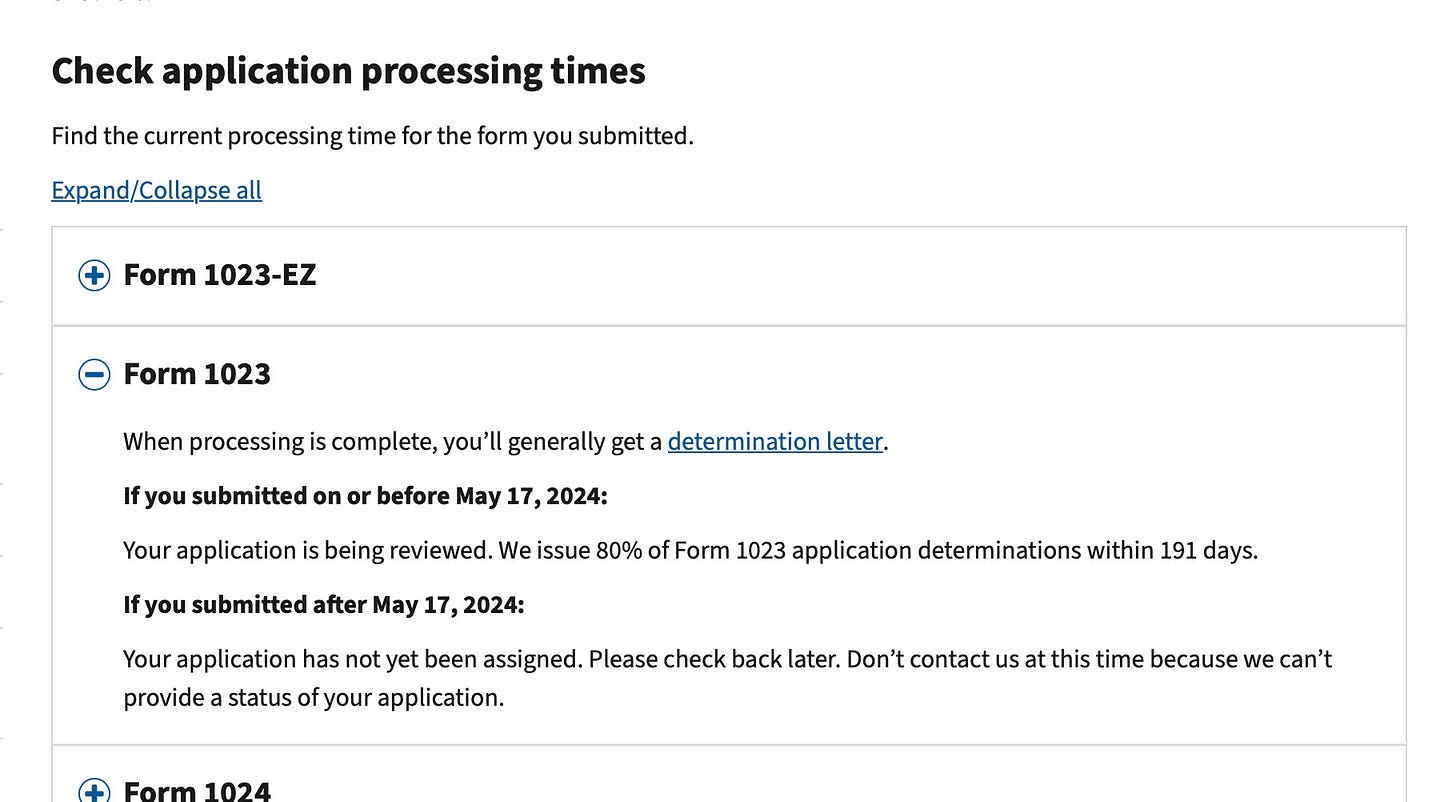

According to the IRS's own admission, there is currently a backlog of about 7 months in processing new applications for tax-exempt status, as detailed on https://www.irs.gov/charities-non-profits/charitable-organizations/wheres-my-application-for-tax-exempt-status#time. This delay has fueled public and legal scrutiny over the IRS's efficiency and impartiality.

The IRS attorneys responded to the writ of mandamus from William Scott in just 5 days, including a weekend.

Conclusion:

This case not only questions the IRS's handling of whistleblower claims but also brings to the forefront the ethical obligations of attorneys under federal law to recuse themselves in cases of conflict of interest. The outcome could influence how conflicts of interest are managed in future IRS-related litigation and might lead to procedural changes to ensure impartiality. Moreover, the delays in processing non-profit status applications underscore ongoing issues with IRS operations, potentially affecting public trust and legal outcomes in tax-related disputes.

For further information on the legal documents, see:

Case 1:24-cv-24123-CMA Document 23 and the Amended Appeal and Petition for Writ of Mandamus filed by William S. Scott.

Watch our award-winning film “Epidemic of Fraud” now and learn more about Gates Foundation's involvement in clinical trials of hydroxychloroquine.

Bill Gates is an evil depraved individual out for profit and depopulation. He deserves prison or worse, not tax exempt status!!!

My family has been on a path that includes the abuse to our bodies within the Gates Foundation .

I always believed in the end of this nightmare it would be the IRS to Ultimately expose this evil CULT !